Home Insurance 2025

Home insurance, often referred to as homeowners insurance, is a critical financial product designed to protect individuals and families from the economic impact of unexpected events that can damage their homes or possessions. This type of insurance typically covers various risks, including natural disasters, theft, vandalism, and liability claims. Homeowners insurance serves as a safety net, allowing property owners to mitigate the financial burden that may arise from such incidents.

One of the primary purposes of home insurance is to safeguard the investment homeowners make in their property. Given the significance of a home in one’s life, both financially and emotionally, it is essential to have proper coverage in place. In the event of damage to the structure of the home or personal belongings, a comprehensive home insurance policy can help cover repair or replacement costs, ensuring that homeowners do not face devastating financial consequences alone.

Moreover, liability protection is another fundamental aspect of home insurance. In cases where someone is injured on the property, homeowners may be held legally responsible. Home insurance often includes liability coverage, which can help pay for medical expenses or legal fees associated with such claims. This protection extends beyond the physical structure to encompass the broader responsibility homeowners have towards guests and visitors.

Overall, home insurance provides peace of mind by offering financial security against unforeseen events. Without adequate insurance coverage, homeowners may find themselves in precarious situations, facing significant losses or liabilities. It is advisable for every homeowner to understand their options and choose a policy that aligns with their specific needs, ensuring that their home remains a sanctuary free from financial distress.

What Home Insurance Covers

Home insurance serves as a vital tool in safeguarding homeowners against potential financial losses stemming from various unfortunate events. Primarily, it covers three essential areas: the physical structure of the home, personal belongings, and liability coverage.

Firstly, the coverage for the physical structure encompasses damages caused by a range of perils. These may include fire, windstorms, hail, and natural disasters like earthquakes and floods, depending on the policy type. Home insurance policies often cover the cost to repair or rebuild the home, which can be invaluable in the case of significant destruction. For example, if a tree falls on your house during a storm, the insurance will assist with the repair costs, ensuring your home remains safe and intact.

Secondly, home insurance extends its protection to personal belongings contained within the house. This includes furniture, electronics, clothing, and appliances. In the event of theft or damage from incidents such as water leaks or fires, homeowners can file claims to receive compensation for the loss or replacement of these items. For instance, if someone breaks into your home and steals valuable items, your policy would typically cover the loss, allowing you to recover financially without undue stress.

Lastly, liability coverage is a critical component that many homeowners overlook. This aspect protects the homeowner from financial liability in case someone is injured on their property. Should an accident occur, such as a visitor slipping on a wet floor or a tree branch falling on a neighbor’s car, the liability coverage will help cover legal fees and medical expenses. Having sufficient liability coverage ensures that you can confidently host guests without fear of potential financial repercussions from unforeseen accidents.

Types of Home Insurance Policies

Understanding the different types of home insurance policies is essential for homeowners seeking to protect their property effectively. The primary categories of home insurance include basic, comprehensive, and specialized coverage options, each tailored to meet varying needs and circumstances.

Basic home insurance policies, often referred to as “named perils” policies, cover a limited scope of risks, specifically those outlined in the policy. Commonly, this type of insurance provides protection against events such as fire, theft, and vandalism. While basic policies may be more affordable, they generally offer less comprehensive protection, leaving homeowners vulnerable to damages from unforeseen events not explicitly covered.

In contrast, comprehensive home insurance policies offer broader coverage that protects against a wide range of risks, including those not listed in the basic option. These policies typically cover damage due to natural disasters, such as earthquakes and floods, which are often excluded from basic plans. Homeowners who invest in comprehensive policies benefit from greater peace of mind, knowing that most potential risks are covered. However, this increased protection often results in higher premiums.

For homeowners with unique needs or situations, specialized home insurance options may be ideal. These policies can be customized to cover specific concerns, such as liability for home-based businesses, protection for high-value items, or coverage for historic properties. While specialized policies can provide tailored protection, they may come with limitations and exclusions that homeowners should be aware of.

Choosing the right type of home insurance policy depends on individual homeowner circumstances, financial considerations, and risk tolerance. By analyzing the features, benefits, and limitations of each type, homeowners can make informed decisions that best suit their unique needs, ultimately ensuring adequate protection of their property and assets.

Factors Affecting Home Insurance Cost

Understanding the factors that influence home insurance premiums is essential for homeowners aiming to manage their insurance expenses effectively. Key elements include the location of the property, its value, the age and condition of the house, and the security measures implemented.

Firstly, the geographical location of a home plays a significant role in determining insurance costs. Properties situated in areas prone to natural disasters, such as hurricanes, floods, or wildfires, typically incur higher premiums. For instance, homes located along coastal regions in Florida face steeper insurance rates due to the increased risk of storm damage. Conversely, homes in less disaster-prone areas, such as the Midwest, often experience more affordable premiums.

The overall value of the property is another critical consideration. Insurance is designed to cover potential losses, so higher-value homes will logically attract increased premiums. This is particularly relevant for homeowners who have made extensive renovations or purchased high-value items, including modern appliances and high-end fixtures. Insurers will assess the total value of the property to ensure adequate coverage, leading to enhanced premiums for more valuable homes.

The age and condition of a house also impact home insurance costs. Older homes might require more frequent repairs and upgrades to meet current safety standards, which reassesses their risk profile for insurers. A well-maintained older home may have lower premiums, whereas one that shows signs of neglect could face significantly higher costs. For example, a house with outdated electrical systems or weakened roofing might prompt insurers to charge more due to the perceived higher risk of claims.

Lastly, the security measures a homeowner puts in place can significantly reduce insurance costs. Homes equipped with modern security systems, smoke detectors, and fire alarms are often rewarded with lower premiums as these features decrease the likelihood of loss due to theft or accidents. Accurate documentation and proof of these safety measures can lead to discounts, illustrating the essence of proactive home management in minimizing insurance expenditures.

Choosing the Right Home Insurance Policy

Selecting the appropriate home insurance policy is a critical decision that requires thorough evaluation and understanding of one’s specific needs. Homeowners should start by comparing various coverage options available in the market. Insurance policies can vary significantly in the scope of coverage provided, so it is vital to assess what each policy entails. Key coverage types often include dwelling coverage, personal property coverage, liability protection, and additional living expenses. Each of these components plays a crucial role in safeguarding your home and investments.

Another important aspect to consider when choosing a policy is the deductibles and premiums associated with it. The deductible is the amount you are required to pay out of pocket before the insurance kicks in, while the premium is the amount you pay for the coverage. Generally, opting for a higher deductible can lower your premium, but it also increases your financial responsibility in the event of a claim. Homeowners should carefully evaluate their financial situation and risk tolerance to determine the most suitable combination of deductible and premium.

When exploring different policies, it is also essential to thoroughly review their specifics. This includes understanding any exclusions or limitations that may affect your coverage, such as natural disasters or other risks that may not be included in standard policies. Additionally, homeowners should assess the claims process for each insurer, as a smooth and transparent experience can alleviate stress during unfortunate events. Evaluating customer service records, industry ratings, and client reviews can provide insight into the insurer’s reliability.

Ultimately, determining adequate coverage levels involves considering the total value of your home, belongings, and potential liabilities. Engaging with a trusted insurance agent can further assist homeowners in navigating their options, ensuring they select a policy that aligns with their specific circumstances and needs. This informed approach to selecting a home insurance policy not only protects your financial stability but also allows for peace of mind in homeownership.

Ways to Save on Home Insurance

Homeowners seeking to reduce their insurance premiums have several strategies at their disposal. One of the most effective methods is bundling home insurance with auto insurance. Many insurance providers offer significant discounts to customers who choose to purchase multiple policies from them. This bundling not only simplifies the management of policies but also makes it easier to track renewals and payments. Moreover, the savings accrued can be substantial, often amounting to 10% or more on overall premiums.

Another approach to consider is increasing your deductibles. A deductible is the amount you pay out-of-pocket before your insurance starts to cover any claims. By opting for a higher deductible, homeowners can lower their monthly premiums considerably. However, it is essential to assess your financial situation carefully, as this means assuming greater risk in the event of a claim. Individuals who are financially prepared to handle higher out-of-pocket expenses might find this an advantageous choice, leading to significant long-term savings.

Implementing home safety upgrades can also contribute to lower home insurance costs. Insurance companies often provide discounts to homeowners who take proactive measures to improve their property’s safety and security. Installing security alarms, reinforcing doors and windows, or adding smoke detectors can lower the likelihood of damage or theft. Furthermore, engaging in energy-efficient improvements might not only reduce utility bills but can also qualify for potential discounts on your home insurance policy, thus creating a dual benefit.

In addition, regularly reviewing and comparing insurance quotes from different providers can yield better pricing options. Homeowners should not hesitate to negotiate with their insurers, especially if they have made significant renovations or improvements to their property. By utilizing these strategies, homeowners can effectively manage their insurance costs while ensuring adequate coverage for their assets.

Common Home Insurance Myths

Homeowners often hold misconceptions about home insurance that can lead to misunderstandings about their coverage. One prevalent myth is that home insurance covers everything related to a home. In reality, while a standard policy does provide broad coverage for specific risks, it does not protect against all potential issues. For instance, damage caused by natural disasters, such as floods or earthquakes, is usually excluded unless additional coverage is purchased. Therefore, homeowners must carefully review their policy to fully understand what is and what is not covered under their particular plan.

Another common belief is that all home insurance policies are the same. This claim is misleading, as coverage options, exclusions, and limits can vary significantly between different insurance providers and policies. Homeowners should be aware that factors such as the home’s location, its age, the materials from which it is built, and the selected coverage limits can influence the terms and conditions of a policy. As a result, obtaining multiple quotes and comparing different policies is essential to find the best option tailored to an individual’s needs.

Additionally, many homeowners wrongly assume that the amount of coverage in their policy reflects the market value of their home. Instead, home insurance typically covers the cost to rebuild the property in case of a total loss, not necessarily its current market price. Market conditions can fluctuate, potentially resulting in a discrepancy between the two values. Therefore, conducting a thorough evaluation of the replacement cost is vital to maintain adequate coverage.

In light of these prevalent myths, it is imperative for homeowners to educate themselves on the specifics of their home insurance policies. Clarity around these misconceptions can help them choose the right coverage that adequately protects their homes and assets.

Understanding Policy Exclusions

Home insurance is designed to provide financial protection against various risks, but it is equally important for homeowners to understand the exclusions that come with their policy. Policy exclusions refer to specific events or types of damages that are not covered by the insurance policy, which can leave homeowners vulnerable in certain circumstances. One of the most critical steps a homeowner can take is to carefully read the fine print of their insurance policy to identify these exclusions and understand their ramifications.

Common exclusions in home insurance policies often include natural disasters such as floods and earthquakes. Many standard policies do not provide coverage for damage caused by these events, which means homeowners in susceptible areas should consider purchasing additional policies or endorsements. Similarly, general wear and tear of the home is typically not covered; insurers expect homeowners to maintain their properties adequately and will not cover the cost of repairs related to maintenance neglect.

Another noteworthy exclusion involves intentional damage. If a homeowner causes damage to their property intentionally or through negligent actions, the insurance provider will usually not compensate for the resulting claims. Additionally, home-based businesses often face exclusions; standard homeowner policies may not cover business equipment or liability associated with business operations conducted at home. Homeowners operating a business should seek appropriate commercial insurance to ensure adequate protection.

Other exclusions may include damages due to mold, pest infestations, or damage resulting from government action. Understanding these exclusions is crucial for homeowners to gain a realistic view of their coverage. By being informed about what their policy does not cover, homeowners can make better decisions regarding their insurance needs, potentially opting for supplementary coverage tailored to protect against specific risks that may arise in their circumstances.

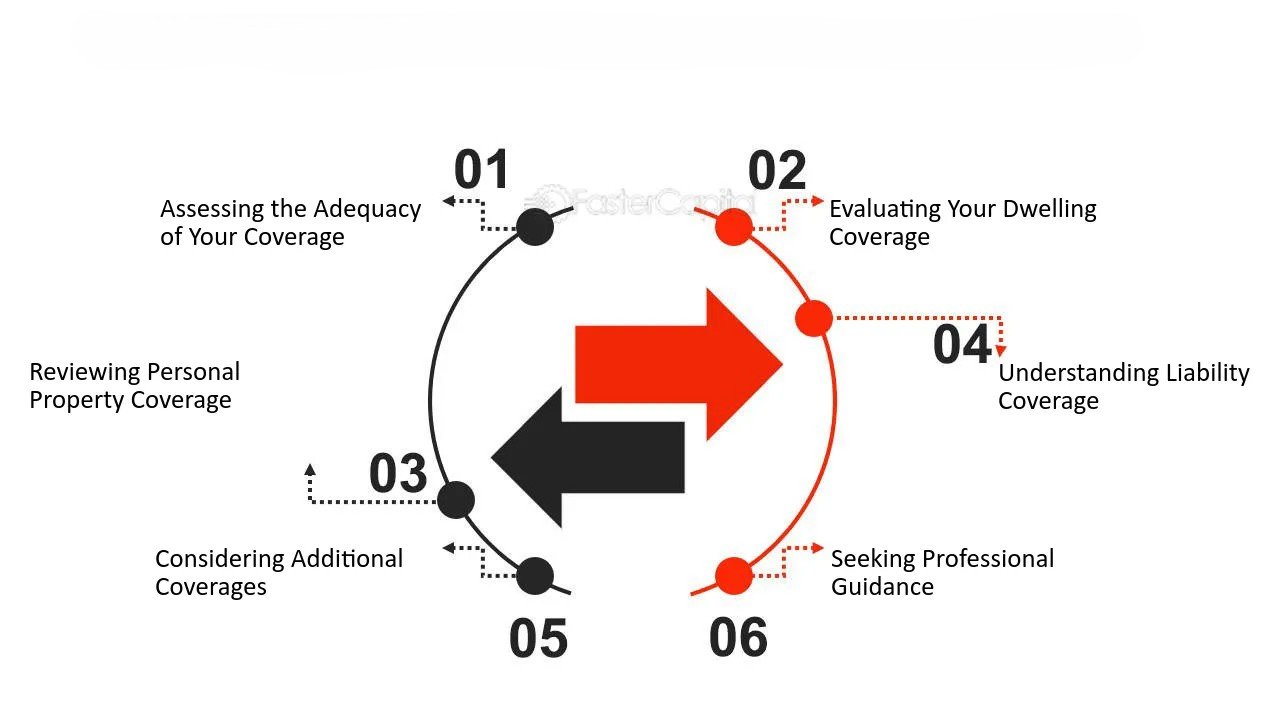

When to Review or Update Your Policy

Homeowners should be aware of several key moments when it is necessary to review or update their home insurance policy. One of the most significant events is the purchase of a new home. When transitioning to a new property, different coverage needs may arise, which necessitates a re-evaluation of existing policies. Ensuring that the new home is adequately protected against potential risks is paramount.

Furthermore, significant renovations or home improvements also warrant a thorough review of your home insurance coverage. Major updates such as adding a room, finishing a basement, or installing a swimming pool can increase the overall value of your property and, consequently, the amount of coverage needed. Failure to inform your insurance provider about these changes may lead to a gap in coverage, leaving you vulnerable in case of an incident.

In addition to significant life events, homeowners should also consider reviewing their policies periodically. Changes in belongings, such as acquiring valuable items like expensive electronics or artwork, should prompt a reassessment of coverage limits. Updating your policy ensures that high-value possessions are protected against theft, loss, or damage. Conversely, if you have disposed of items or if their value has depreciated, it’s advisable to adjust your coverage accordingly. This proactive approach not only helps in maintaining adequate protection but also can lead to potential discounts.

Additionally, changes in local real estate markets may affect the level of coverage required. For instance, if property values in your area rise significantly, your current policy may no longer suffice in fully covering your home and belongings in the event of a loss. Regularly assessing your insurance policy and making necessary updates ensures that you remain adequately protected and that your policy reflects your current circumstances.