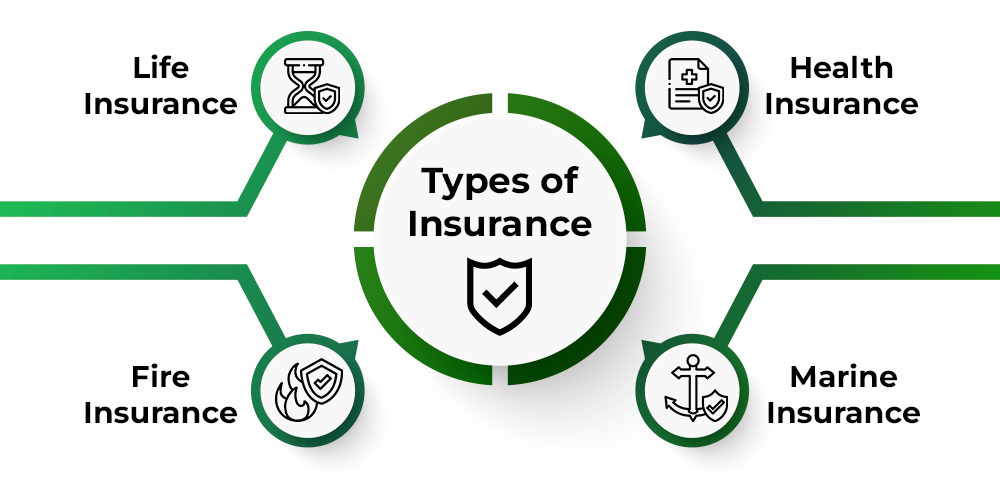

Types of Insurance

Insurance is fundamentally a risk management tool designed to provide financial protection against unforeseen events that can adversely affect individuals and businesses. At its core, the principle of insurance is based on the idea of pooling resources; policyholders contribute to a collective fund, from which claims are paid out when members of the group encounter losses. This mechanism serves to help mitigate the economic impact of unexpected disruptions, whether they arise from accidents, natural disasters, or other adverse occurrences.

The primary purpose of insurance is to offer a safety net that allows individuals and businesses to manage risk effectively. By opting for insurance products, individuals are better equipped to protect their financial stability against significant losses. This is particularly relevant in today’s fast-paced world, where the potential for accidents or emergencies can never be entirely eliminated. Insurance ensures that, in the event of such incidents, policyholders are not left to face financial ruin alone.

Understanding various types of insurance is crucial for anyone looking to safeguard personal and business assets. Whether it pertains to health, property, automobile, or liability insurance, each category serves a unique function within the broader context of financial protection. Familiarity with these types not only empowers individuals to make informed decisions but also enhances their ability to navigate life’s uncertainties with greater confidence. Furthermore, in the realm of business, having the appropriate insurance coverage ensures compliance with regulations while guarding against potential lawsuits and liabilities.

In today’s complex environment, the importance of insurance cannot be understated. By recognizing its value and making the right choices, individuals can achieve greater peace of mind, knowing they have taken proactive steps to secure their financial futures. This comprehensive understanding lays the foundation for a more detailed exploration of the various types of insurance available in the market today.

Life Insurance: Securing the Future

Life insurance serves as a crucial financial safety net, ensuring that dependents are protected in the unfortunate event of the policyholder’s passing. It provides a means to cover outstanding debts, funeral expenses, and ongoing living costs, thereby preventing financial strain on loved ones. Understanding the different types of life insurance is essential when considering which policy best fits individual needs.

The two primary categories of life insurance are term life insurance and whole life insurance. Term life insurance offers coverage for a specific period, typically ranging from 10 to 30 years. This type of policy is often more affordable and is designed to provide financial security during critical years, such as when raising children or paying off a mortgage. Conversely, whole life insurance guarantees coverage for the policyholder’s entire lifetime and includes a cash value component that accumulates over time. This accumulation can be accessed during the policyholder’s lifetime or borrowed against, making it a versatile financial tool.

When choosing a life insurance policy, several factors should be taken into account to ensure it meets your specific needs. The coverage amount is paramount; it should adequately reflect the financial requirements of your dependents in your absence. Additionally, consider the beneficiaries of the policy. It is advisable to keep the beneficiary designation updated to ensure that the intended individuals receive the benefits. Moreover, assess your own financial situation, including debts, income, and savings, to determine how much coverage is appropriate. Consulting with a financial advisor can further assist in selecting a policy that aligns with your long-term goals and financial security.

In conclusion, life insurance is a vital element in financial planning. By understanding the different types of policies and considering essential factors such as coverage amount and beneficiaries, individuals can secure their family’s future and navigate potential financial challenges during difficult times.

Health Insurance: Protecting Your Well-being

Health insurance is an essential aspect of safeguarding one’s well-being and financial stability. It serves the primary function of covering medical expenses, which can be substantial and unpredictable. Without adequate health insurance, individuals may face overwhelming costs associated with doctor visits, hospitalizations, surgeries, preventive care, and medications. These expenditures can significantly impact personal finances, making it imperative to have a robust coverage plan in place.

There are several types of health insurance plans available, each catering to different needs and circumstances. Employer-sponsored plans are one of the most common options, where businesses offer coverage to their employees as part of their benefits package. These plans often include a variety of coverage options, cost-sharing arrangements, and preventive services at reduced costs. For those who are self-employed or seeking alternatives, individual coverage plans provide flexibility in customization to better fit personal health requirements.

Government programs, such as Medicare and Medicaid, play a crucial role in providing coverage for specific populations. Medicare typically serves individuals aged 65 and older, and those with certain disabilities, offering various parts that cover hospital stays, outpatient services, and prescription drugs. Conversely, Medicaid is designed for low-income individuals and families, ensuring that they have access to necessary healthcare services without incurring crippling expenses.

When selecting the right health insurance plan, it is advisable to consider factors such as coverage options, network size, premiums, deductibles, and out-of-pocket maximums. Individuals should assess their healthcare needs, budgetary constraints, and access to preferred providers before making a decision. By doing so, one can ensure that their health insurance plan adequately protects their well-being and aligns with their financial goals.

Auto Insurance: Safeguarding Your Vehicle

Auto insurance is a vital component of vehicle ownership, providing protection for both drivers and their assets. It is designed to mitigate financial risks associated with accidents, theft, and other unforeseen events that may affect your vehicle. Not only is auto insurance essential for financial security, but in many jurisdictions, it is also a legal requirement that mandates drivers to maintain a minimum level of coverage.

An auto insurance policy typically comprises several key components. The most critical of these is liability coverage, which handles the costs for bodily injury and property damage inflicted upon other parties in an accident where you are at fault. This type of coverage protects you from potentially overwhelming financial burdens resulting from lawsuits or medical expenses that might arise from vehicle incidents.

Collision coverage is another important aspect of auto insurance that protects your vehicle in the event of an accident, regardless of who is at fault. Collision insurance helps cover repair or replacement costs for your vehicle after a collision with another car or an object, providing peace of mind that you can reclaim some of your investment in your vehicle.

Additionally, comprehensive coverage offers protection against non-collision incidents, such as theft, fire, or natural disasters. This type of policy is essential for vehicle owners who live in areas prone to such risks, as it ensures that they are safeguarded against potential losses outside of typical driving scenarios.

Several factors influence auto insurance premiums, with the most significant being a driver’s record. Those with a history of accidents or traffic violations may face higher rates due to perceived risk. Moreover, the type of vehicle also plays a crucial role; high-performance or luxury cars typically incur higher insurance premiums due to their increased repair costs and likelihood of theft. Understanding these elements is essential for any vehicle owner aiming to secure proper auto insurance coverage.

Home Insurance: Protecting Your Haven

Home insurance serves as a critical financial safeguard for homeowners, designed to protect one of their most significant investments: their property. This type of insurance helps cover losses and damages to the structure of the home and the personal belongings within it. There are several types of home insurance policies available, each tailored to meet varying needs and circumstances. Homeowners’ insurance is the most commonly utilized option, providing coverage for the dwelling, personal property, liability, and additional living expenses if the home becomes uninhabitable due to a covered event.

Alternatively, renters’ insurance caters to individuals who do not own the property they occupy. This form of insurance primarily protects tenants’ personal property against risks such as theft, fire, or other specified hazards, while also providing liability coverage in case someone is injured during their stay. It is vital for renters to understand that, unlike homeowners’ insurance, renters’ policies do not cover the building itself; this responsibility falls upon the landlord.

In addition to standard homeowners’ and renters’ insurance, homeowners may want to consider additional coverage options to further protect their properties from specific risks. These may include flood insurance, which is essential for homes in designated flood zones, and earthquake insurance, crucial for those living in seismically active regions. Evaluating the coverage needs pertinent to an individual’s specific situation is paramount for ensuring comprehensive protection. This includes assessing factors such as location, property value, and personal assets.

Overall, securing the right home insurance policy is an integral step in safeguarding one’s haven. By understanding the various types of coverage available and their associated benefits, homeowners can make informed decisions that protect their investments and peace of mind.

Business Insurance: Ensuring Business Continuity

Business insurance plays a crucial role in safeguarding companies against a myriad of risks that could threaten their continuity and financial stability. Businesses, regardless of size, face unique risks that can arise from various sources, including natural disasters, accidents, and legal claims. Understanding these risks and securing the appropriate levels of coverage is essential for mitigating potential losses and ensuring long-term success.

One of the most common types of business insurance is general liability insurance. This coverage provides protection against legal claims of bodily injury or property damage resulting from the company’s operations, products, or services. It acts as a safety net, enabling businesses to cover legal fees, medical expenses, and settlements, thereby protecting their assets and reputation.

Another vital form is professional liability insurance, also known as errors and omissions insurance. This type of coverage is particularly important for businesses that provide professional services or advice, as it protects against claims of negligence, misrepresentation, or failure to deliver promised services. Having professional liability insurance can reassure clients and stakeholders of the business’s commitment to quality and responsibility.

Property insurance is also a fundamental aspect of business insurance. It protects physical assets such as buildings, equipment, and inventory against risks like fire, theft, or vandalism. For both small and large businesses, this coverage is essential to ensure that they can swiftly recover and continue operations following a damaging event.

When selecting the appropriate business insurance, companies should consider factors including industry-specific risks, the size of the business, and the assets that require protection. Small businesses, often operating with limited resources, need to prioritize coverage that offers comprehensive protection without overextending their budgets. In contrast, larger businesses may need more specialized policies tailored to their complex operations. Through careful assessment of risks and objectives, businesses can secure the right insurance coverage that not only protects their assets but also enhances business continuity.

Specialized Insurance: Niche Coverage Options

Specialized insurance is designed to address specific needs that standard insurance policies may not fully cover. As consumers become more aware of their unique requirements, the demand for niche coverage options has increased. These specialized insurance products cater to various situations, such as travel, pets, and liability, ensuring that policyholders are adequately protected in circumstances that might otherwise leave them vulnerable.

Travel insurance, for instance, is an essential consideration for individuals planning domestic or international trips. It typically covers unforeseen events such as trip cancellations, medical emergencies, lost luggage, and even travel delays. By analyzing potential risks associated with their travel plans, individuals can determine if purchasing travel insurance would provide peace of mind and financial security during their journey. Furthermore, the importance of this type of insurance has grown since the onset of the pandemic, emphasizing the need for coverage against unforeseen health emergencies while abroad.

Pet insurance is another example of specialized coverage that has gained popularity among pet owners. This insurance can help mitigate the financial burden associated with veterinary bills for accidents, illnesses, or chronic conditions. As pet ownership continues to rise, understanding the available insurance options is crucial for ensuring the health and well-being of furry companions. Pet owners should assess their situation by considering their pets’ age, breed, and health history when deciding if this type of coverage is necessary.

Liability insurance also provides essential protection in various contexts, such as for landlords, homeowners, and professionals. This specific type of insurance can safeguard individuals from potential lawsuits due to accidents or injuries occurring on their property or as a result of their services. Assessing the need for liability insurance involves evaluating personal risk factors, making it an essential consideration in preserving one’s assets.

The Importance of Insurance: Risk Management

Insurance plays a crucial role in the realm of risk management, providing a safety net that shields individuals and businesses from unexpected financial burdens during times of crisis. By transferring potential risks to an insurance provider, policyholders can safeguard their assets against various unforeseen events, such as accidents, natural disasters, or significant health issues. This transfer of risk is essential, as it ensures that individuals can recover from significant losses without completely depleting their financial reserves.

One of the primary benefits of insurance is the peace of mind it affords. Knowing that there is a financial cushion available in the event of a catastrophe allows policyholders to live their lives and operate their businesses without the constant worry of loss. For individuals, having health or home insurance means they can focus on recovery rather than facing overwhelming costs related to medical care or property damage. For businesses, liability insurance protects against lawsuits and claims, ensuring that they can continue operations despite potential legal challenges.

Moreover, insurance encourages responsible behavior and prudent decision-making. When individuals and businesses invest in various coverage options, they are often more mindful of their actions and choices, contributing to overall risk reduction. For example, a business with comprehensive workman’s compensation insurance is more likely to prioritize workplace safety to minimize claims. This intrinsic connection between insurance and risk management helps create a culture of caution, benefitting both the insured and the broader community.

In conclusion, the importance of insurance in risk management cannot be overstated. It serves not only as a protective measure against potential financial instability but also fosters a sense of security that allows individuals and businesses to thrive despite the uncertainties of life. The implementation of insurance plays a pivotal role in managing risks effectively, ensuring that both personal and commercial interests are sufficiently protected.