What is Smart Insurance?

Smart insurance represents a significant evolution in the insurance industry, integrating cutting-edge technologies to transform traditional coverage models. At its core, smart insurance leverages data analytics, artificial intelligence (AI), and the Internet of Things (IoT) to create a more personalized, responsive, and efficient insurance experience. Unlike traditional one-size-fits-all policies, smart insurance tailors coverage to reflect individual risk profiles, usage patterns, and behavior, making it far more relevant and cost-effective.

One prominent example of smart insurance is usage-based insurance (UBI). UBI allows policyholders to pay premiums based on their actual behavior rather than traditional assessments. For example, in auto insurance, telematics devices track driving habits such as speed, braking, and mileage, enabling insurers to adjust premiums based on real-time data. This results in more accurate risk assessments, potentially offering lower premiums for safe drivers and motivating them to adopt better driving habits.

Another standout product within the smart insurance space is peer-to-peer (P2P) insurance. This innovative model allows groups of individuals to pool their resources and share risks. P2P insurance promotes community engagement, transparency, and mutual trust, as participants have a shared interest in each other’s well-being. Unused funds in the pool may be refunded to members or used to lower future premiums, fostering a sense of collective responsibility and enhancing the value of the insurance.

Additionally, smart insurance incorporates real-time data monitoring, enabling insurers to offer more precise underwriting, faster claims processing, and proactive risk management. For instance, wearable devices in health insurance track fitness levels and habits, rewarding policyholders with discounts for maintaining healthy lifestyles. This shift from reactive to proactive management allows insurers to offer tailored coverage, addressing the unique needs of consumers rather than applying broad, one-size-fits-all solutions.

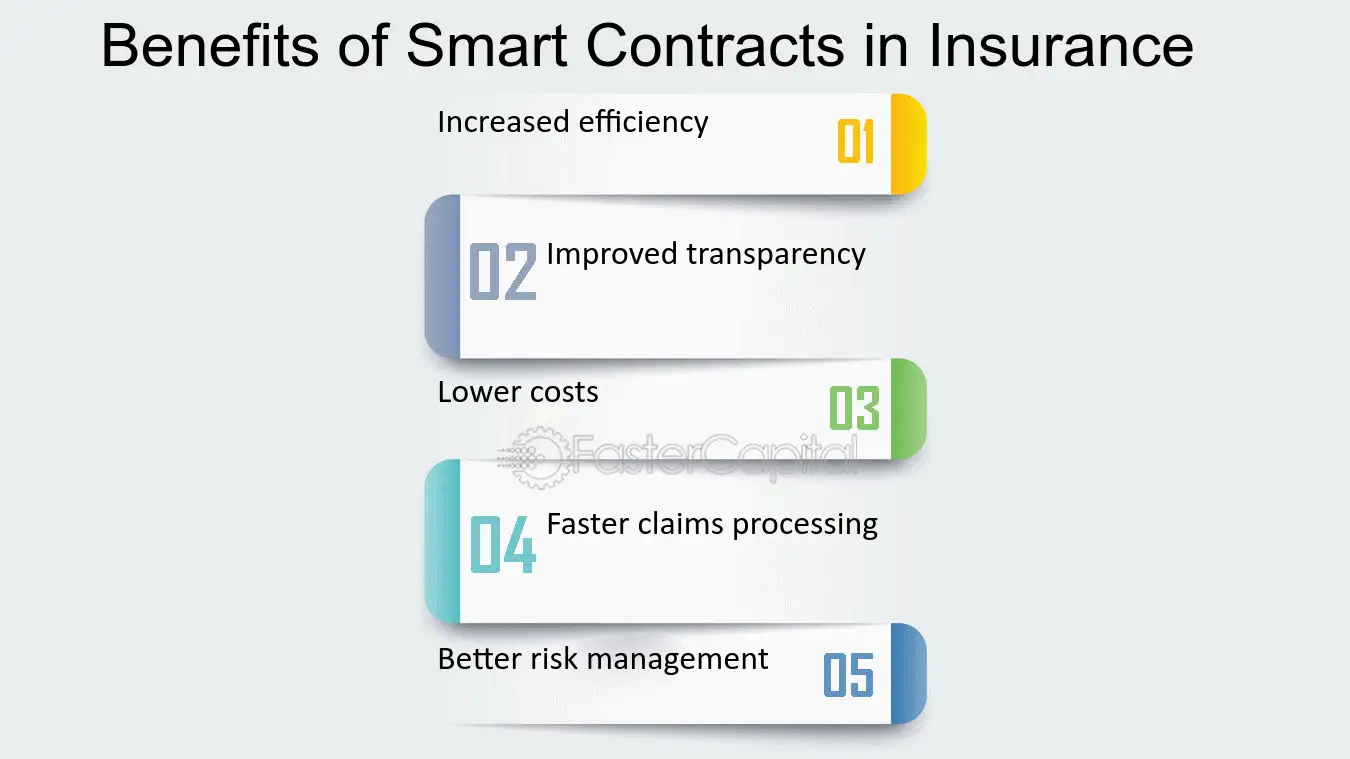

The benefits of smart insurance are clear: improved affordability, increased transparency, better risk management, and enhanced user experiences. By utilizing AI, IoT, and other emerging technologies, smart insurance creates a future where consumers have more control over their coverage and costs. As the industry continues to evolve, smart insurance will play a pivotal role in redefining how we protect assets, health, and well-being—offering a more dynamic, personalized, and efficient approach to insurance worldwide.

The Role of Technology in Smart Insurance

Future of Smart Insurance In recent years, technological advancements have dramatically transformed the insurance sector, giving rise to what is now called smart insurance. The integration of artificial intelligence (AI), machine learning, and the Internet of Things (IoT) has significantly enhanced various operational aspects within the industry. By utilizing these innovative technologies, insurance providers can improve risk assessment, streamline claims processing, and offer personalized coverage options to clients.

AI plays a crucial role in automating numerous processes within the insurance realm. For instance, AI algorithms can analyze vast amounts of data at extraordinary speeds, identifying trends and predicting risks associated with individual clients. This capability allows insurers to tailor their offerings more effectively, catering to the specific needs of each policyholder. Various companies, such as Lemonade and Root Insurance, have successfully embraced AI in their operations, leading to more efficient underwriting processes and improved customer experiences.

Machine learning, a subset of AI, further enhances risk evaluation by enabling systems to learn from historical data and adapt accordingly. This means that insurers can predict and quantify risks more accurately over time, adjusting their policies and pricing structures in response to emerging trends. Additionally, machine learning algorithms can continuously learn and refine their predictions based on customer behavior, helping to personalize insurance products.

Moreover, IoT devices, including telematics in vehicles and connected home devices, are central to the evolution of smart insurance. These devices collect real-time data, allowing insurers to offer usage-based insurance policies that provide discounts based on an individual’s behavior. Companies like Metromile leverage this technology to provide pay-per-mile car insurance, which not only benefits low-mileage drivers but also promotes safer driving behavior through feedback provided by the telemetry data.

As these technologies continue to evolve, they hold the potential to revolutionize the insurance landscape, making coverage more accessible, efficient, and tailored to the needs of consumers. The future of smart insurance lies in harnessing these technological advancements to create a more responsive and personalized insurance experience.

Benefits of Smart Insurance for Consumers

Smart insurance in 2025 has dramatically transformed the way policyholders interact with their insurance coverage, offering a host of benefits that were once unattainable with traditional policies. One of the primary advantages is the level of personalization it provides. By harnessing the power of advanced data analytics and artificial intelligence (AI), smart insurance systems analyze individual behaviors and preferences to tailor policies specifically to each client’s needs. This customization not only improves customer satisfaction but also ensures that policyholders only pay for the coverage they truly require, maximizing the value of their policy.

Another major advantage of intelligent insurance is cost efficiency. Conventional insurance schemes follow, in general, risk estimates that may lead to overcharging some and underinsurance of others. On the contrary, smart insurance employs real-time data for a more precise assessment of individual risk levels, potentially lowering premiums for many. For example, usage-based auto insurance gives bonuses to safe driving habits through discounts on a safe driving basis, creating a more just and individualized pricing system.

Smart insurance also greatly enhances the claims process, an area where traditional models often fall short. In many cases, claims processing can be slow, confusing, and frustrating for consumers. Smart insurance addresses these challenges by utilizing digital platforms and automation to streamline claims submissions and resolution. Some providers even offer mobile apps that allow users to submit claims instantly, including required documentation, accelerating the entire process. According to an Accenture study, companies that have adopted smart insurance practices report a nearly 50% improvement in claims satisfaction.

Finally, smart insurance facilitates improved customer engagement. With continuous communication through digital channels, insurers can provide timely updates, helpful tips, and personalized advice tailored to individual policyholder needs. This ongoing interaction fosters a stronger relationship between the insurer and the insured, promoting customer loyalty and creating more informed consumers. As a result, smart insurance not only delivers value through cost savings and convenience but also builds trust and satisfaction throughout the customer journey.

Challenges Facing Smart Insurance

Smart insurance in 2025, while representing an evolution in the insurance sector, is not without its challenges and limitations. One of the primary concerns surrounding smart insurance is data privacy. As insurers increasingly leverage data analytics and connected devices to assess risk, the influx of personal information raises significant privacy issues. With customers’ sensitive data being collected, the need for robust protocols to safeguard this information becomes paramount, as breaches can lead to not only financial loss but also a breach of trust between insurers and their clients.

Cybersecurity risks further complicate the landscape of smart insurance. As technology becomes deeply integrated into insurance processes, the potential for cyber threats also escalates. Hackers may exploit vulnerabilities in connected devices or the underlying software platforms, jeopardizing the integrity of data and operations. Consequently, the insurance industry must invest substantially in cybersecurity measures to protect against unauthorized access and cyberattacks, ensuring that both their own systems and their clients’ sensitive information are safeguarded.

Another hurdle for smart insurance involves regulatory compliance. The rapid pace of technological advancement often outstrips the ability of regulatory frameworks to adapt, resulting in a patchwork of rules that can be difficult for insurers to navigate. This discrepancy may hinder innovation, as companies become wary of the legal implications of utilizing cutting-edge technologies. Additionally, integrating new technologies with legacy systems poses a significant challenge. Many insurers rely on outdated infrastructure, which can be cumbersome to integrate with advanced data analytics and IoT devices. To fully realize the potential of smart insurance, collaboration across the industry is crucial. Insurers, technology providers, and regulators must work together to develop standards that promote innovation while ensuring privacy and security.

Smart Insurance vs. Traditional Insurance

Smart insurance represents a significant evolution in the insurance industry, distinguishing itself from traditional insurance models through several key attributes. One notable difference lies in coverage options. Smart insurance often utilizes technology to provide highly customized policies based on individualized risk assessments. These policies can dynamically adjust coverage based on real-time data and usage patterns, particularly evident in sectors such as automotive and health insurance. In contrast, traditional insurance often relies on broad categorizations that may not accurately reflect an individual’s specific risk profile, potentially leading to less tailored protection.

Pricing is another critical area of distinction. Smart insurance employs advanced algorithms and data analytics to determine premiums, which can lead to more competitive and fair pricing structures aligned closely with actual risk levels. This contrasts with traditional insurance pricing, which typically uses static models and demographics, meaning customers might pay higher premiums without receiving the corresponding level of service or coverage tailored to their needs.

Risk assessment methodologies also vary significantly between the two models. Smart insurance capitalizes on continuous monitoring and machine learning to assess risk in real-time, allowing for timely adjustments to coverage and rates. Traditional insurance, on the other hand, often utilizes historical data and less frequent assessments, which may result in outdated risk evaluations and potentially increased liability in rapidly changing contexts.

Overall, smart insurance improves the customer experience with friendly platforms that offer smooth interactions. Policyholders are also provided with mobile apps and online portals, allowing them to access their information and make real-time adjustments. While traditional insurance options may allow for a sense of stability and familiarity, there are times when smart insurance, with its flexibility and technology-enabled features, might offer more advantages.

Thus, while smart insurance offers several benefits, there remain scenarios where traditional models may still suit particular consumer needs and preferences.

The Future of Smart Insurance

The insurance landscape is undergoing a profound transformation, driven by technological innovations and shifting consumer expectations. One of the key components in this evolution is the rise of smart insurance, which leverages telematics and artificial intelligence (AI) to redefine coverage options and enhance customer experience. As we look towards the future, several trends are poised to shape the smart insurance industry over the next decade.

Telematics, the integration of telecommunications and real-time data collection, will likely become more widespread in smart insurance. As more individuals adopt connected devices and vehicles, insurers will have unprecedented access to user behavior data. This information can be used to tailor premiums and policies based on real-time risk assessments, leading to personalized coverage that reflects the actual usage patterns of insured individuals. Furthermore, the expanded implementation of telematics can provide significant cost savings for both insurers and policyholders.

Advancements in AI technology are also expected to play a crucial role in the future of smart insurance. AI algorithms will enhance underwriting and claims processing, allowing for faster decisions and more accurate risk evaluations. Machine learning models can analyze vast amounts of data to predict claims frequency and severity, thus enabling insurers to adjust their strategies accordingly. As AI tools become more sophisticated, they will help create a more efficient and responsive insurance ecosystem.

Consumer preferences are shifting toward greater transparency, accessibility to information, and personalization due to common use practices. Consumers are more likely to be sensitive to the…one-size-fits-all coverage policy and will likely prefer coverage that meets their individual needs and circumstances. Smart insurance creates a space for the insurers to bring this expectation to reality through data analytics, which enhances engagement and communication with the customers.

In summary, the coming of telematics, AI development, and change toward consumer demand for personalized coverage mark the chapter of smart insurance. These trends will cumulatively redefine standards and practices within the insurance sector in pursuit of more efficient and customer-oriented risk management.

Case Studies: Success Stories in Smart Insurance

In the evolving landscape of insurance, several firms have emerged as frontrunners by integrating smart insurance solutions into their operations. One prime example is Lemonade, an insurtech company that leverages artificial intelligence to streamline claims processing. By using chatbots and machine learning algorithms, Lemonade has successfully reduced the time it takes to handle claims, enhancing customer satisfaction significantly. The innovative use of technology not only improved efficiency but also empowered higher levels of transparency among clients, a critical factor in building consumer trust.

Another noteworthy case is that of Metromile, which specializes in pay-per-mile auto insurance. Through the deployment of telematics, Metromile gathers data on driving patterns to create personalized policies. This approach has allowed them to cater to low-mileage drivers, offering them a fairer and more flexible pricing model compared to traditional auto insurance products. The challenge Metromile faced was ensuring data privacy and gaining regulatory approvals for their telematics technology. However, by actively addressing these concerns and prioritizing data security, they managed to carve a niche market while fostering customer loyalty through tailored experiences.

Moreover, State Farm has made strides in the smart insurance space by introducing usage-based insurance (UBI) programs. Their Drive Safe & Save initiative rewards policyholders for safe driving, utilizing mobile technology to monitor driving behavior. This strategy not only incentivizes safe driving habits but also allows the firm to mitigate risk and potentially lower the overall cost of claims. State Farm’s approach illustrates how existing insurance companies can innovate by adopting smart technologies while building a culture of safety among policyholders.

These case studies exemplify the successful implementation of smart insurance solutions, showcasing various innovations and the hurdles faced along the way. They provide valuable insights for other companies in the insurance sector looking to enhance their offerings through smart technologies.

How to Choose Smart Insurance Products

When considering smart insurance products, it is essential to take a systematic approach to ensure that your choice aligns with your coverage needs and lifestyle preferences. Firstly, begin by identifying your specific insurance requirements. Understand the potential risks associated with your environment, ensuring that the policies you explore provide adequate protection. This evaluation can help you prioritize the features you deem essential in a smart insurance policy.

Next, delve into the various coverage options available within smart insurance offerings. Many tech-enabled insurance solutions utilize data analytics to tailor coverage based on user behavior, which can result in more personalized and often more affordable premiums. Evaluate these customized options by reviewing the factors they consider, such as driving habits for auto insurance or predictive analytics for home insurance. This understanding can prevent gaps in coverage, enabling you to select a policy that best suits your unique situation.

Additionally, ensure that the smart insurance products you are interested in prioritize data security. Given the reliance on technology to gather and analyze personal data, it is crucial to verify the measures in place to protect your sensitive information. Examine the company’s privacy policy, data encryption practices, and how they handle your data during and after the policy period. Opting for a provider with a solid reputation for data security can help mitigate concerns about privacy breaches.

Moreover, consider reading customer reviews and industry ratings to gauge the overall satisfaction of other policyholders. This research will provide insights into the efficacy of the claims process, customer service responsiveness, and the overall stability of the insurance provider. By carefully assessing these factors, you can make an informed decision when choosing smart insurance products that not only meet your coverage needs but also align with your trust and security expectations.

Concluding Thoughts on Smart Insurance

In recent times, the insurance industry has undergone a significant transformation, primarily driven by advancements in technology. This evolution has paved the way for the emergence of smart insurance, characterized by data-driven decision-making and personalized coverage options for policyholders. The integration of technologies such as artificial intelligence, the Internet of Things, and big data analytics has allowed insurers to tailor their offerings more closely to individual needs, resulting in enhanced customer experiences.

Throughout this discussion, we have explored how smart insurance is revolutionizing risk assessment and pricing strategies. By utilizing IoT devices, insurers can gather real-time data that offers deeper insights into policyholders’ behavior and risk profiles. This allows companies to develop innovative pricing models, rewarding customers for adopting safer practices and ultimately reducing the frequency and severity of claims. The shift toward a more proactive approach in managing risks is a hallmark of the smart insurance paradigm.

Furthermore, the customer-centric nature of smart insurance cannot be overlooked. With greater access to information and streamlined processes through digital platforms, consumers are empowered to make informed decisions about their coverage. As the industry continues to evolve, companies are urged to embrace digital transformation, ensuring they remain competitive while fostering a culture of transparency and trust with their clients.

As we close this review of smart insurance, the relationship between technology and insurance will continue to grow, thus opening up more opportunities and issues. It is expected that readers reflect on how a smart insurance can play a role in their own lives and stay tuned for further discussion of what this could mean for the future of coverage. While this industry trend is still expanding, active participation in discussions and a readiness to adapt will be demanded from both consumers and providers.